capital gains tax increase uk

These reports suggest amendments to the existing system. The change to capital gains tax went live when the budget was announced on 27th October 2021 and relates to property sales.

6 Free And Cheap Ways To File Your Taxes Online Tax Accountant Accounting Capital Gains Tax

The amount of tax levied on capital gains could be raised by billions of pounds according to a new report.

. In the last six months the Office of Tax Simplification OTS has published two reports evaluating the effectiveness of the capital gains taxation system in the UK. You know at the end of the day its a tax on profits they are actually realised profits. 40 on assets and property.

More closely aligning UK capital gains tax CGT rates with income tax rates could raise significant revenues for the UK a government-commissioned review has concluded. Rates for capital gains tax between 2021 and 2021-22 as well as between 2020 and 2020. Capital gains tax chart.

The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year. Taxes united-kingdom capital-gains-tax capital-gain. In a report published today.

In July 2020 the Chancellor asked the OTS to carry out a review of CGT. The UKs Office for Tax Simplification has released a new report on overhauling the UKs CGT system. 45 on assets and property.

Income tax is charged at a basic rate of 20 per cent rising to 40 per. Now that window has increased to 60 days. Yes so I think capital gains tax potentially will increase.

In the event of a property sale if the sale resulted in capital gains tax the profits will be taxed at 18 on the sale value or 28 on the income if the sale resulted in capital gains tax. UK Capital Gains Tax. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as.

You previously had 30 days to report any gains made from the sale and pay the tax you owed to HMRC. The influential Resolution Foundation is pushing for the Chancellor to restrict relief on capital gains tax and inheritance tax and introduce a council tax supplement of one percent on properties worth more than 2million. Capital Gains Tax - UK.

Capital gains tax rates on most assets held for a year or less correspond to. This article discusses the journey of capital gains tax CGT in the last. 2 days agoTax rates on capital gains are set for 2021-22 and 2020-21.

Among the extremely rich the 50000 people who make up the 01 the amount declared in capital gains grew by 213 between 2007 and 2017. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate. The first 12300 of gains is.

Corporation tax and capital gains tax are central to the governments plan to help address the deficit that is on its way to 400bn 559bn this year. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket.

Have you heard of any potential CGT increases in the UK. Theres talk of CGT capital gains tax increasing in the US if Biden gets in. Tax rates on capital gains are set for 2021-22 and 2020-21.

About 14bn could be raised by cutting exemptions and doubling rates according to the. The capital gains tax on most net gains is no more than 15 percent for most people. Taxes on the gain from selling other assets rise to 10 for taxpayers with basic tax rates and to 20 for taxpayers with.

Putting the S in OTS. A taxpayer at a lower rate pays 10 for gains from other assets while. Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit.

Currently there are four rates of CGT being 18 and 28 on UK residential property and 10 and 20 on all other assets the rates depending on whether the taxpayer pays basic or higher rates of tax. 17 November 2020. Another one from Alan.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. The rate of capital gains tax you pay remains the same but the extended window gives you. Just seen in reports about the new budget that CGT in the UK will be likely to increase from 28 to 40 from April which will impact anyone selling any stock after the new financial year starts.

If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers. CGT is charged on gains at 10 per cent for basic rate taxpayers and 20 per cent for higher and additional rate taxpayers. When will capital gains tax increase uk Thursday April 28 2022 Edit In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Getty The most likely option is to increase CGT rates in line with income tax Moore said which would increase the. Taxes united-kingdom capital-gains-tax capital-gain. The Autumn Budget is weeks away and capital gains tax could soon rise Image.

20 on assets 28 on property. 20 on assets and property. 20 on assets 28 on property.

The capital gains tax rate upon the sale of a property depends on whether you have a basic or higher rate of tax with general-rate taxpayers paying 18 and higher-rate taxpayers paying 28 respectively. UK chancellor Rishi Sunak unveiled a raft of tax hikes across multiple areas and what dates they will be implemented. 10 on assets 18 on property.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Chancellor announces that corporation tax will increase from 19 to 25 in 2023.

Pin By Nawaponrath Asavathanachart On 1945 Capital Gains Tax Germany And Italy Capital Gain

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

Pin By Correctdesign On Menu Iphone App Samples Tax Table Capital Gains Tax Accounting

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

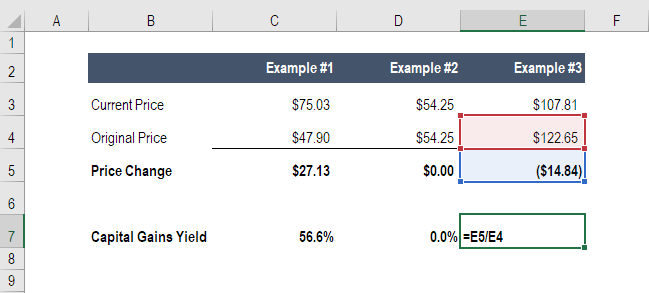

Capital Gains Yield Cgy Formula Calculation Example And Guide

Selling Stock How Capital Gains Are Taxed The Motley Fool

Difference Between Income Tax And Capital Gains Tax Difference Between

Https You 38degrees Org Uk Petitions Increase Tax On Unearned Assets Like Shares And Second Homes Bucket Email Blas Budgeting Open Letter Business Investment

Capital Gains Tax Overview Types Of Capital Gains Tips

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

What Is Investment Income Definition Types And Tax Treatments

Tax Tips For The Individual Forex Trader Tax Deductions Capital Gains Tax Stock Market

Introduction Of Pit Exemption Of Capital Gain Derived From Sale Of Asean Stock On Asean Linkage Property Valuation Capital Gains Tax Getting Into Real Estate

What Is Capital Gains Tax Capital Gains Tax Capital Gain What Is Capital

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Difference Between Income Tax And Capital Gains Tax Difference Between